How Customer Data Analysis Can Inform Your Business

Analyzing your customer database can be overwhelming. There’s a lot of raw data to comb through covering everything from digital body language to product usage to communication records to payment history and more.

But, the payoff is worth the effort because customer data analysis can help you understand the current state of your business and make informed decisions around how you should operate in order to scale.

Here are five areas to consider when doing customer data analysis:

1. Who are my customers?

There’s a difference between determining your ideal customer profile and identifying the concrete profile of your actual customer base.

Does the theory align with reality? Do the firmographic characteristics of your customer base align with your ICPs? Are there commonalities among your customers that should be added to your ICPs?

2. Who are our best customers?

Who are we best at acquiring? Who are we best at retaining? Who are we best at expanding? Why do customers stay with you? What causes customers to expand?

If you’re not acquiring who you retain the best, high churn rates can make it difficult for your company to scale. Additionally, just because a customer is being retained doesn’t mean they’re expanding.

Acquisition, retention and expansion all drive customer lifetime value (CLV), and understanding the causes of the three can help you identify where you have leverage to increase CLV.

3. Understanding your customer cohorts

How do your customer groups differ based on when they were acquired? Are your trends improving or decreasing?

Looking into cohort performance in relation to how your business operates over time can reveal what’s driving revenue performance along.

The most common time frames to do cohort analysis for are 13 months and 25 months.

Since customers have just crossed the 1-year mark, it’s common to see a big wave of churn at the 13-month mark. You can also see where friction is arising during engagements and learn where issues from the sales process start to impact customer relationships. The larger scope of a 25-month analysis can go deeper into those same issues in addition to highlighting weaknesses in long-term product adoption.

Depending on how your company operates, it might also be beneficial to look at shorter time periods that align with your contract lengths.

4. Who’s just trying out my product, who are the users and who are the evangelists?

Are your churn numbers being overinflated by trials? If you have a freemium model or see people frequently paying for short engagements in order to try out your product or service, you should consider what your definition of a customer actually should be.

What level of contract or feature usage indicates someone’s a customer or power-user? When are users expanding? Does expansion happen on different timelines for different company sizes?

What causes someone to become an evangelist? Are there leading indicators of evangelism you can track and nurture?

5. How did your customers become customers?

What channels are your customers coming through? What messaging worked best? What marketing assets are most commonly being leveraged during the buying process?

In terms of the ratio between customer acquisition cost (CAC) and CLV, which channels are most effective? Do you have channels or campaigns bringing in disproportionate numbers of poor-fit customers?

The Business Areas Customer Data Analysis Can Inform

The benefit of customer data analysis is not solely what you can learn, but also how you can apply the knowledge you’ve gained. The insights from customer data analysis can help you optimize multiple business strategies.

Who you should be focusing your acquisition efforts on

An understanding of who your best-fit customers are and which channels are most effective can help you hone your marketing and sales efforts.

You don’t want to invest heavily in channels that aren’t paying off, and you don’t want to keep bringing in customers who have a high churn probability. The insights gained from customer data analysis can help you avoid that and pivot your strategy instead to where you can have the biggest positive impact.

Service delivery and customer success

Different types of customers are varying levels of informed when they make a purchase decision. Understanding the background different customer segments are coming from enables you to provide them with the information they need in order to gain value from your solution.

Additionally, identifying trends where drop-offs in usage or retention occur will allow you to proactively combat them with playbooks and processes that address the causation. This will create a better experience for your customers and make your team more efficient and effective.

Pricing and discounting

Pricing has an impact on the perception of your product. You don’t want to be offering discounts solely because it’s time to renew if they’re not needed to close the deal.

Understanding the value customers are obtaining from products and services along with what steps you want them to take enables you to make better pricing decisions.

For example, if you’re trying to cross-sell because you know using a set of products in tandem correlates with increases in retention and expansion, it might be worth offering a discount to entice that action.

Product packaging

Customer data analysis can indicate what products and services work best together for different customer segments. Knowing this can help you better position your upsell and cross-sell pitches.

If your company uses a land-and-expand sales strategy, the insights from customer data analysis can also tell you what’s the best initial product to open the door and what the ideal path to expand from there is.

When pursuing expansion opportunities, it’s important to take a customer-centric approach and presenting solutions that will help them with their challenges. Without knowledge from customer data analysis, companies can fall into the trap of pushing the products they want to sell over what’ll be best for the customer long term.

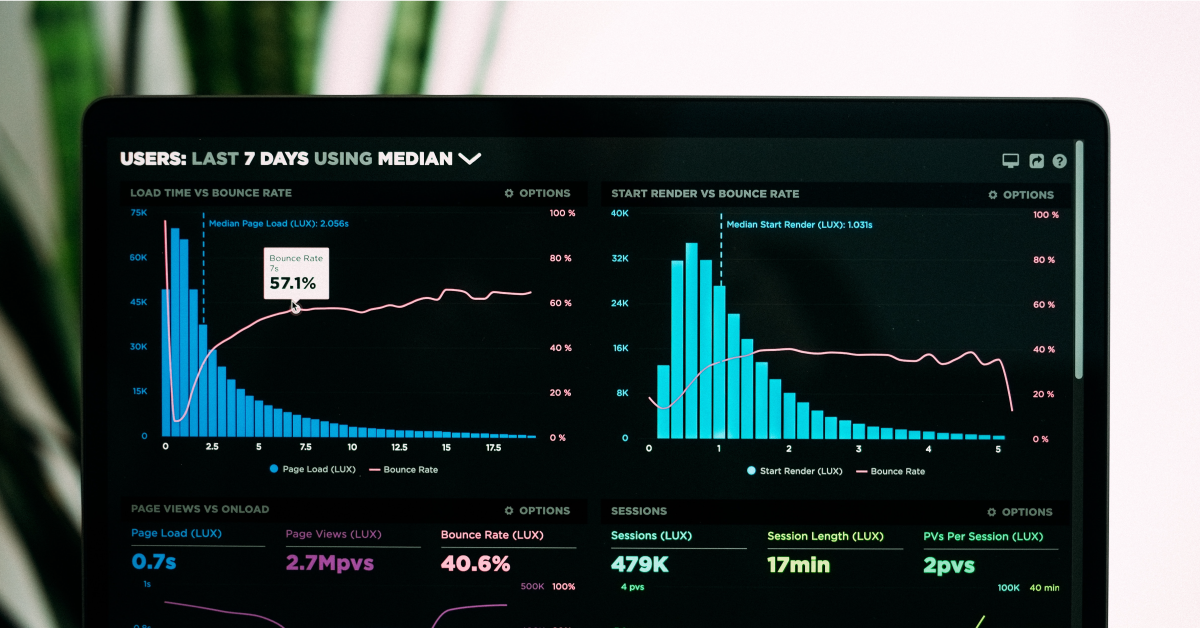

Phases of Analytics

As your working with your customer data, there are different types of analytics you’ll employ:

- Descriptive analytics: identifying what’s going on

- Diagnostic analytics: determining how are things trending

- Predictive analytics: hypothesizing what might happen

- Prescriptive analytics: determining what actions you should take

Utilizing these different phases of analytics is a journey, and while you might experience some phases concurrently when it comes to customer data, you need to progress through all four in order to achieve the best results.

You can’t determine what actions you should take without understanding the current state of your customer experience. And, you can’t make an informed decision without understanding the impact that decision could have.

Customer data analytics help you operate your company around the needs of your customers, and in doing so, you optimize your revenue.

Quinn Kanner

Quinn is a writer and copyeditor whose work ranges from journalism to travel writing to inbound marketing content.